The Community Finance initiative provides access to low-interest loans and financial literacy.

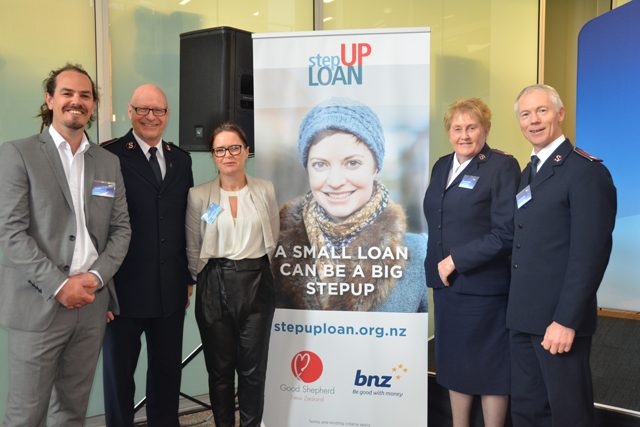

When applying for loans, low-income families in New Zealand will most likely face one of two outcomes: be denied, or be approved for a loan with interest rates so high they won’t be able to meet the required payment on time. To help, The Salvation Army New Zealand Territory partnered with Good Shepherd, the Ministry of Social Development, and Bank of New Zealand to establish the Community Finance initiative.

“We saw the program as a response to the high-end lenders in our communities who were keeping people trapped in loans with crippling interest rates, repossessions of goods and ongoing budgeting difficulties,” said Major Pamela Waugh, Territorial Social Services and Community Ministries Secretary. “Often these loans had been taken for basic needs and purposes. Our scheme is aimed at the lower-income people who needed access to good low interest finance and help with learning financial literacy.”

The Community Finance initiative offers repayable loans to those on low incomes so they can effectively manage debt, build financial literacy, and improve their quality of life.

To qualify for loans, applicants must be on a low income from work or benefits, hold a Community Services Card, have lived at their current address continuously for at least the past three months, and be able to repay a loan. If they meet the criteria and are approved, The Salvation Army will monitor repayments and provide support and financial education throughout the span of the borrower’s loan.

One of the plans available is the No Interest Loan, which provides low-income individuals or families affordable credit to purchase essential household items or services. The loan amounts are typically between $300 and $1,000 and can be repaid with affordable plans of up to 18 months.

The second and most popular plan available is the Step UP low-interest loan. Loans can run from $1,000 to $5,000 at an interest rate of 6.99 percent for a maximum repayment plan of 36 months. These loans can be used for purchasing second-hand cars or repairs, education expenses, beds, furniture and even funeral arrangements.

“For those who wouldn’t have borrowed from other sources, they are able to access a new household asset, which will improve quality of life,” Matt Halsey, Microfinance Manager of Good Shepherd, said in a statement. “We have had a number of people use a loan to buy a car and gained employment they wouldn’t have been able to get without the car.”

The Community Finance initiative was established in 2014, and is housed in The Salvation Army Community Ministry Centers in Manukau, Waitakere and Mt. Wellington. With the success of the original three centers, The Community Finance program will soon also be offered Whangarei, Napier, Palmerston North, Porirua, Wellington and Invercargill.

“Our model is designed to use community-based groups, usually social service providers, to deliver our program to the clients” Halsey said. “[The Salvation Army corps] are best places to do this as they ‘know’ their communities, have strong relationships with them and are able to provide wraparound social services to complement the loans and financial conversations.”

By eliminating high interest rates and unexpected penalty payments that are often tied to typical loan programs, The Community Finance program helps customers avoid unsustainable debt.

“We want to relieve poverty in all forms so financial literacy is an vital part of the process—teaching people how money works and what loans actually do cost.” Waugh said. “If we are then to provide good basic loans, then we can shift the high end lenders out of the market while supporting families to have good financial outcomes.”